Supply

Rare earth supply is dominated by Chinese producers which accounted for approximately 84% of global supply in 2022. Total dependence on Chinese domestic supply has been reducing with increased external supply from Malaysia, USA, Russia, Vietnam, and India.

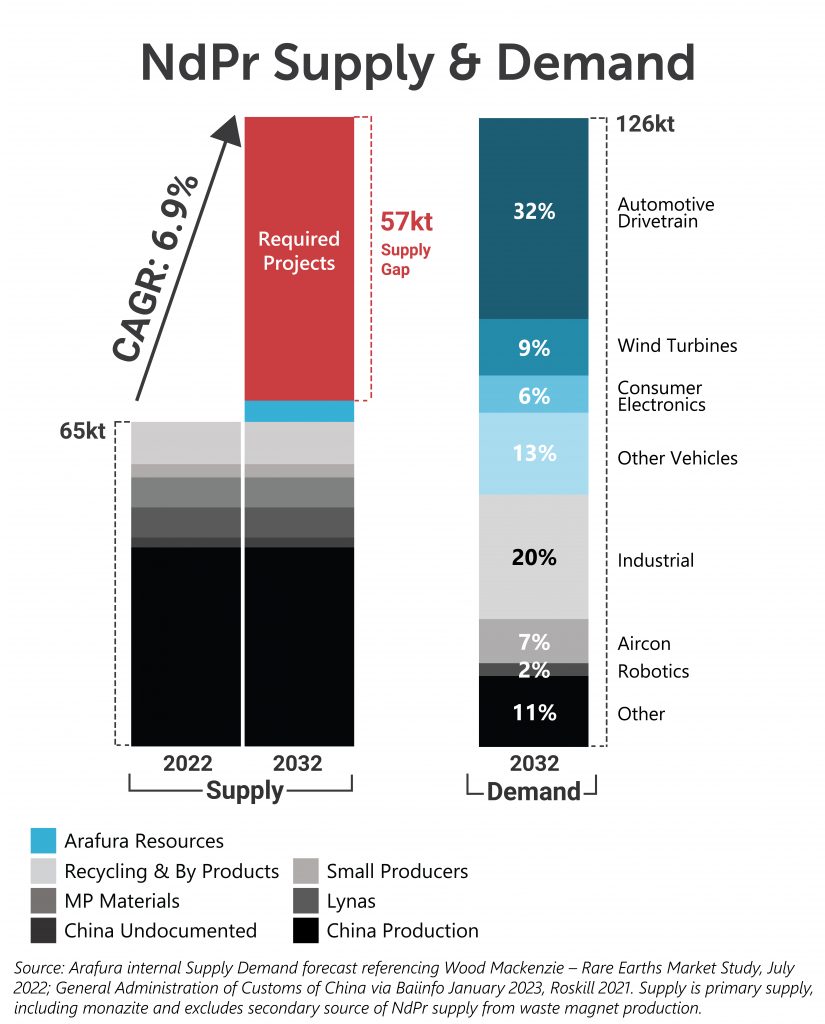

Official Chinese rare earth production in 2022 was 161,000 tonnes of total rare earth oxide (TREO), equating to 40,000 tonnes of NdPr oxide with the total global supply at 65,000 tonnes. To meet projected demand in 2032, global supply for NdPr oxide needs to expand by 61,000 tonnes.

Continued implementation of Chinese Government policy and environmental regulation will restrict future domestic supply. When coupled with projected strong demand for NdPr oxide, China will, ‘under clear policy’, seek additional supply outside the mainland to support their Made in China 2025 strategy. To meet projected demand over the next decade, additional supply is expected to be developed in Australia and North America, and China’s grip on global supply is expected to reduce by 2030.

Demand

Rare earths remain critical in various applications with future demand expected to remain strong driven by the clean energy economy through e-mobility and wind power. Global consumption of rare earths reached 164,000 tonnes of TREO in 2022 and is forecast to increase to 231,000 tonnes by 2032. China will continue to dominate global markets, strengthen its supply chain and increase the use of rare earths in e-mobility with expected strong growth for NdPr oxide in Neodymium Iron Boron (NdFeB) magnets used in electric vehicle (EV) traction motors.

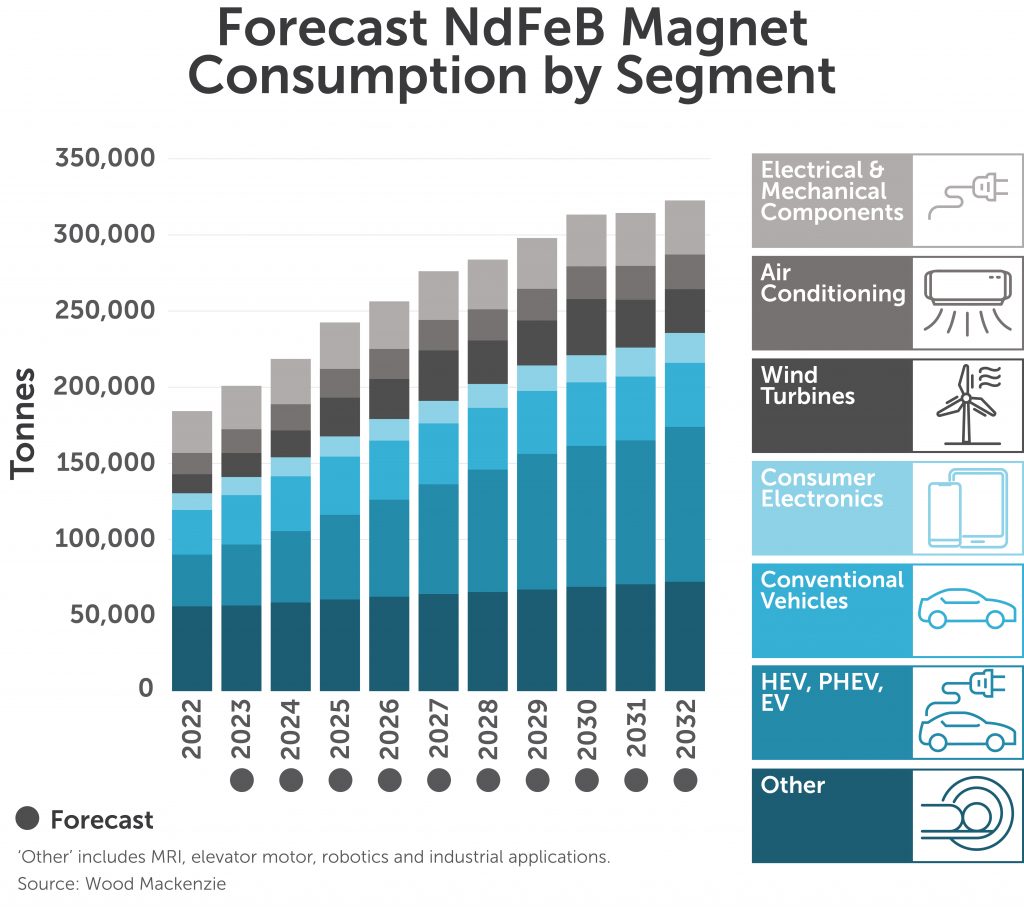

Rare earths used in NdFeB magnets represent the single largest segment by application, accounting for 45%. The use of NdFeB magnets in the automotive, wind turbines and factory automation sectors are the biggest growth applications for NdPr oxide demand. The growth in NdFeB magnets since 2005 is attributed to increased use in the automotive industry, in particular electric drivetrains and electric power steering used in battery, plug-in hybrid and hybrid EVs. Passenger EVs have grown from 450,000 in 2015 to almost 10 million units in 2022 with forecast worldwide expansion of EVs predicted to grow to 34 million in 2030.

Global consumption of sintered NdFeB magnets in 2022 was 184,000 tonnes. NdFeB magnet consumption is forecast to grow by 5.8% per annum in the foreseeable future with demand reaching 322,000 tonnes in 2032. Use of NdFeB magnets in EVs is forecast to account for 32% of total demand by 2032.