Arafura Resources published the results of its Definitive Feasibility Study (DFS) for the Nolans project in February 2019. The work carried out as part of the DFS has built on previous concept and pre-feasibility level of accuracy studies, and extensive metallurgical test work programs, commissioned by Arafura since 2005.

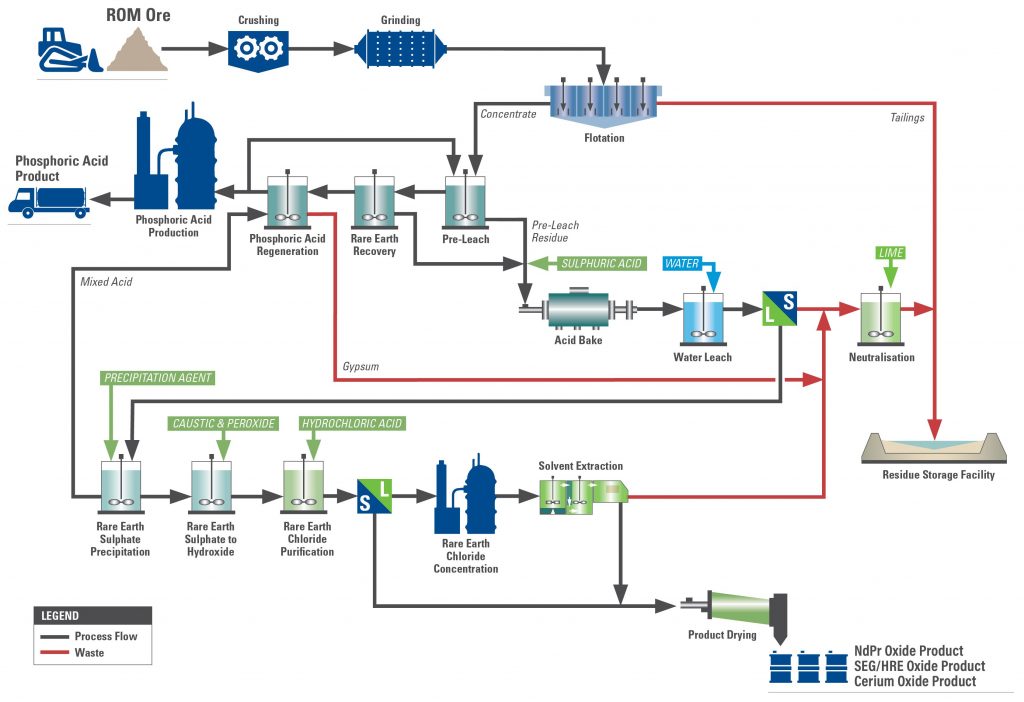

Below is a detailed flowsheet used in the DFS.

A range of independent consultants contributed to the DFS, including Hatch (Lead Engineer), Mining Plus, AMC Consultants, Knight Piésold Consulting, Simulus, GHD, JRHC Enterprises, Ride Consulting, Strategic Human Resources, Roskill, CRU and Qube Bulk.

Capital and operating costs estimates for the DFS have been developed in line with an AACE Class 3 estimate with a target accuracy of ±15%.

DFS Results

A Summary Report for the DFS is available via the link above.

The DFS determined that the project’s flowsheet is technically and economically viable to treat Nolans ore. Arafura can position Nolans as a viable long-life, low-cost alternative supplier of NdPr oxide, 100%-domiciled in a jurisdiction with low political risk.

While the DFS has been subsequently updated much of the work and information in the DFS remains the basis of the Nolans Project.